Samsung Premium TV Pricing Analysis 2026: How Memory Costs are Challenging the Mini-LED and OLED Market

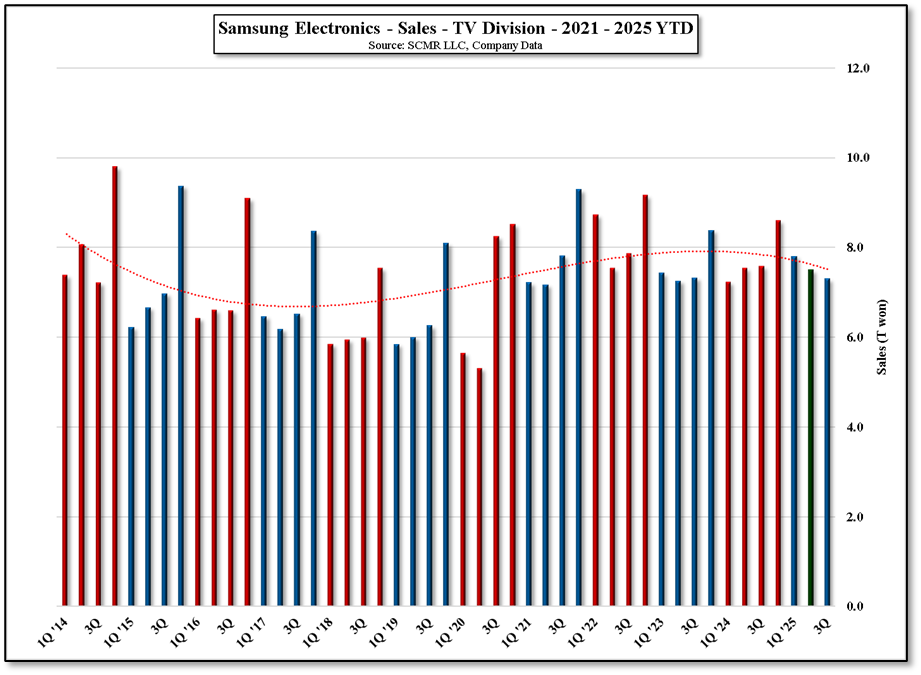

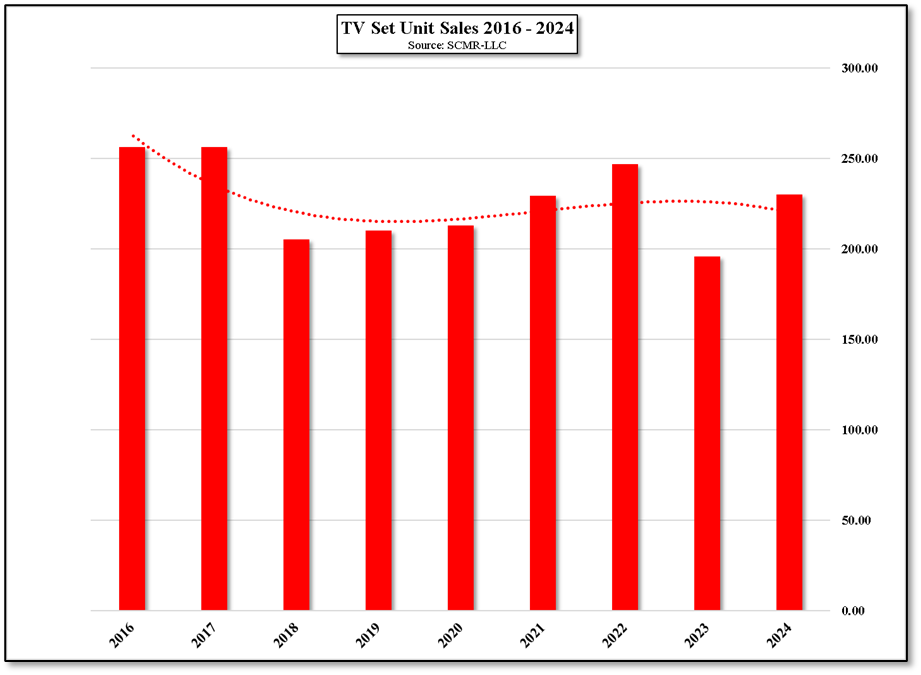

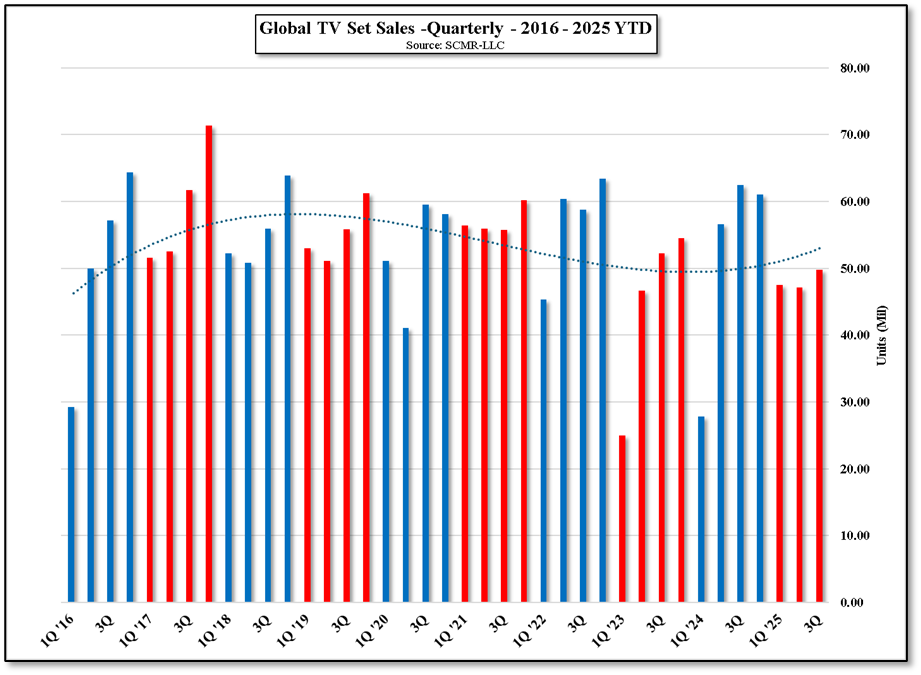

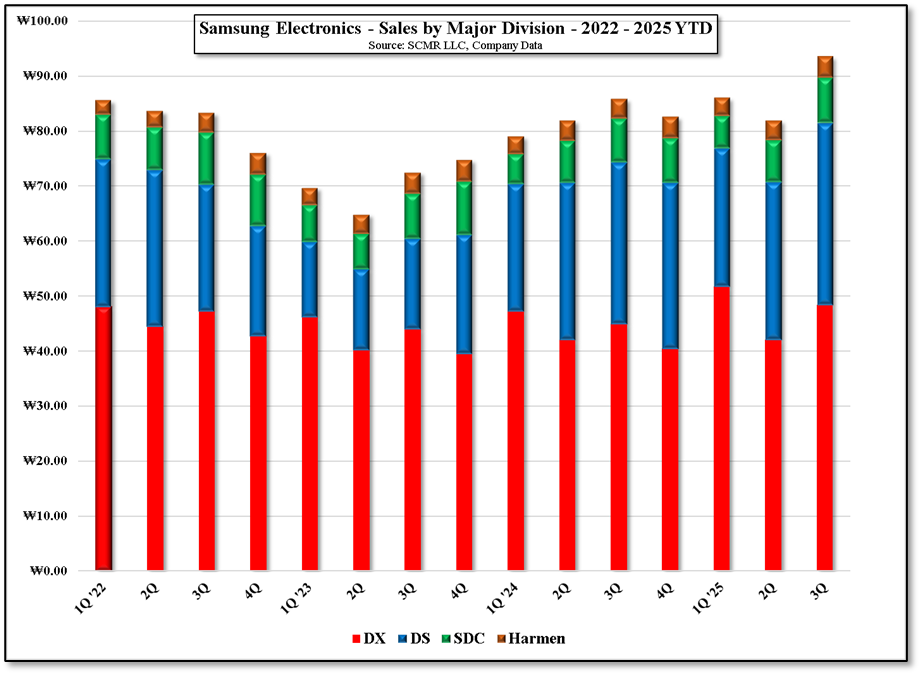

Samsung (005930.KS) is the largest TV set brand in an industry that ships between 206 million and 225 million sets each year (2020 – 2024), with Samsung’ holding a yearly TV set share average ranging from 16% to 26.2% over the last 5 years. We have been tracking Samsung’s premium TV set line since they began offering Mini-LED and OLED TVs (2021 and 2022 respectively) to understand both pricing patterns and the influence of macro events on TV set pricing from the viewpoint of the consumer rather than from a more technical specification perspective.

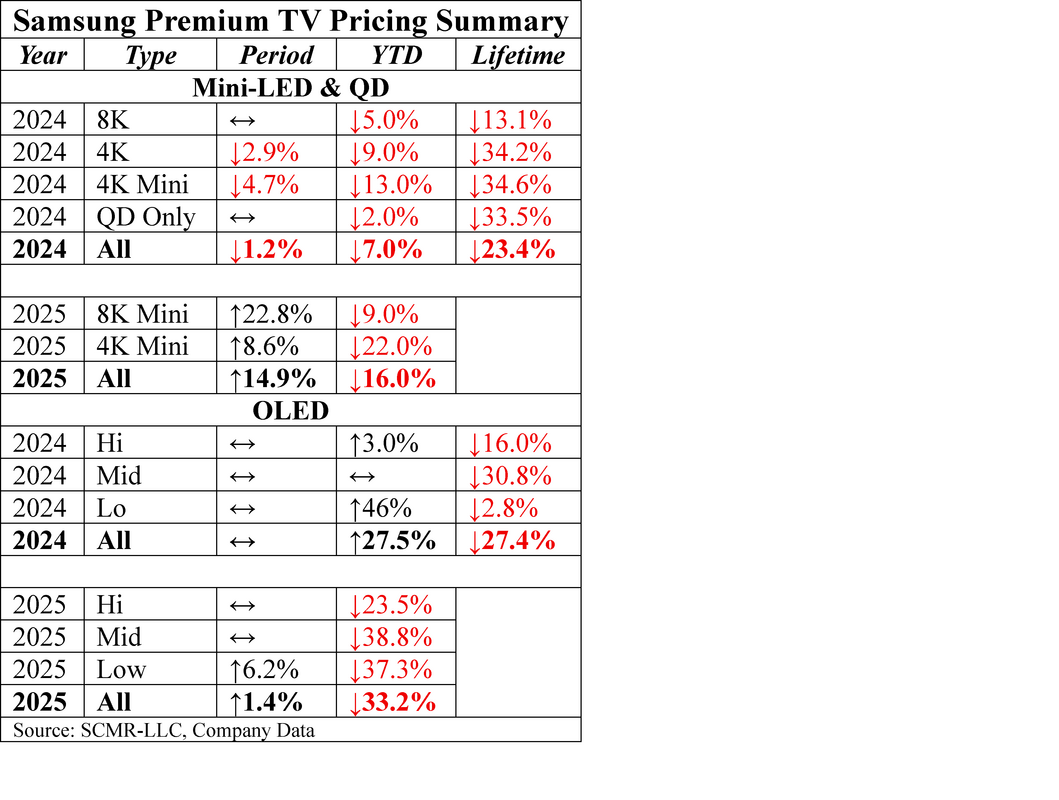

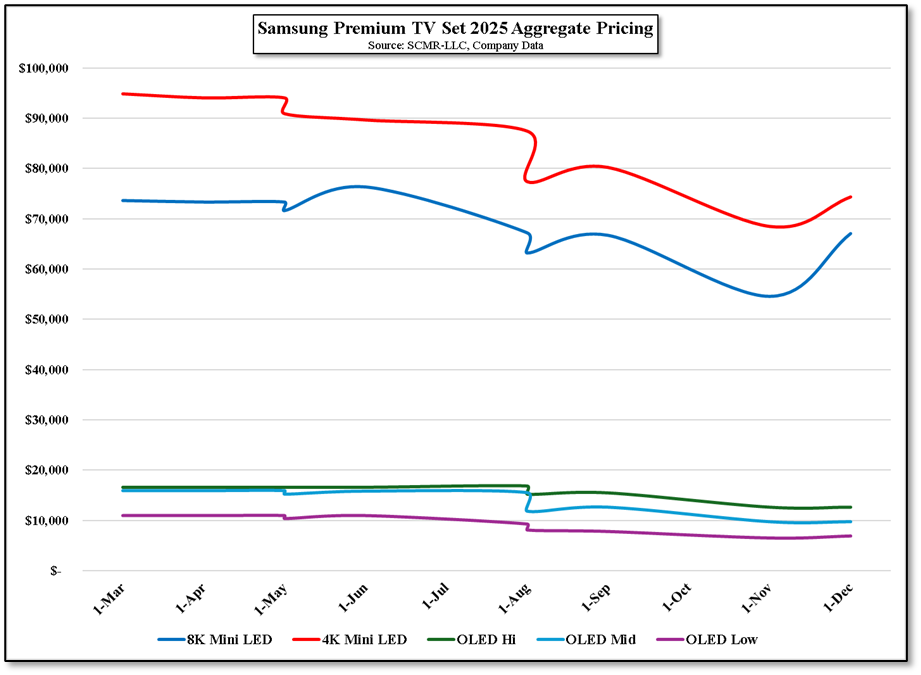

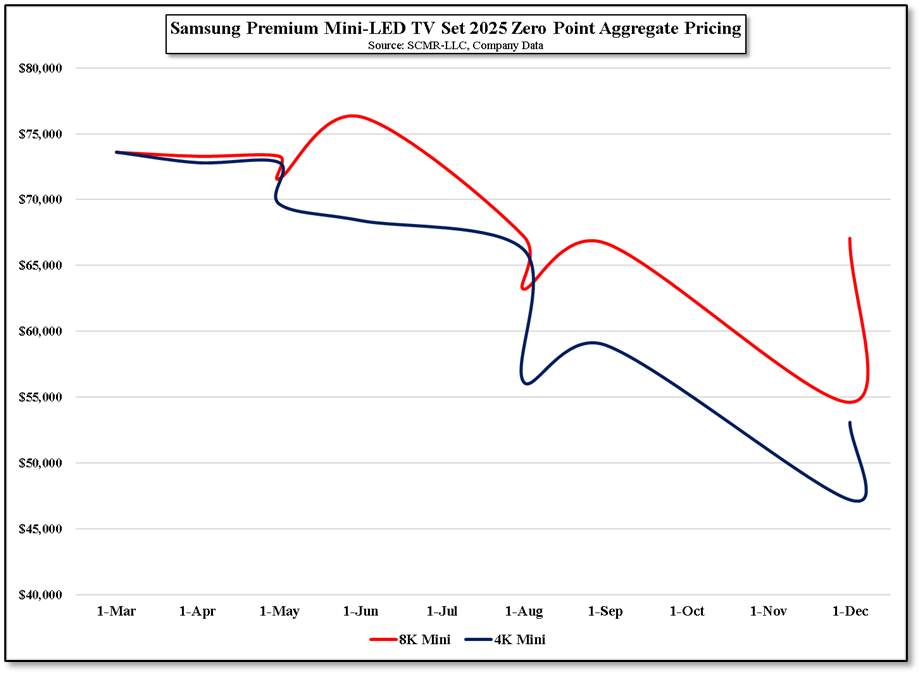

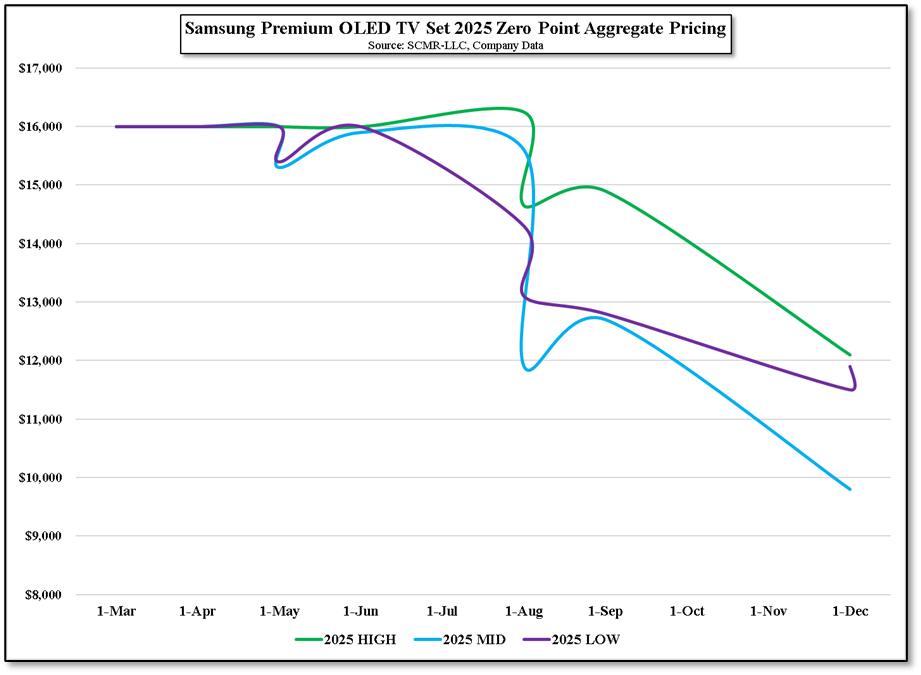

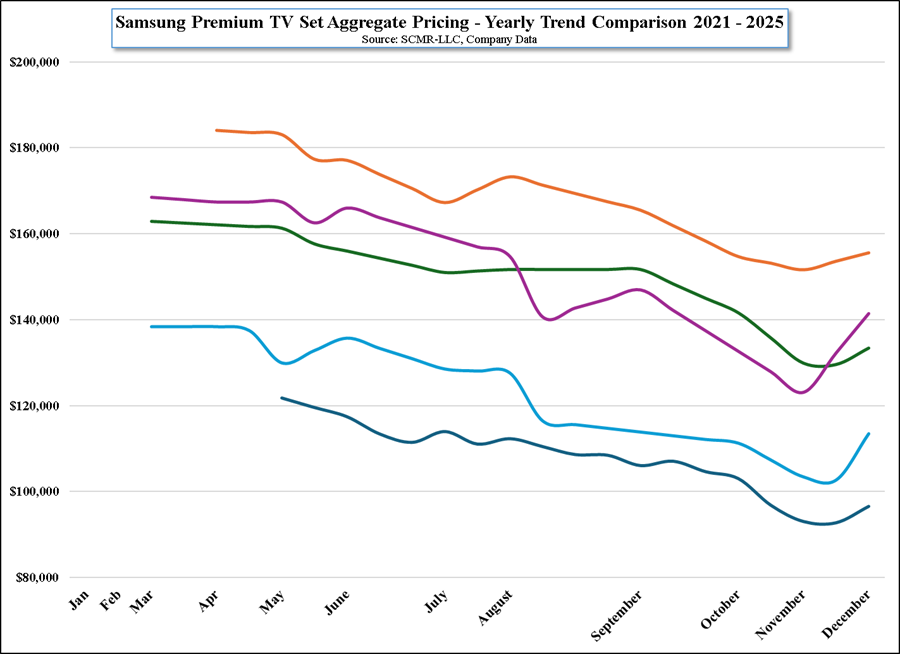

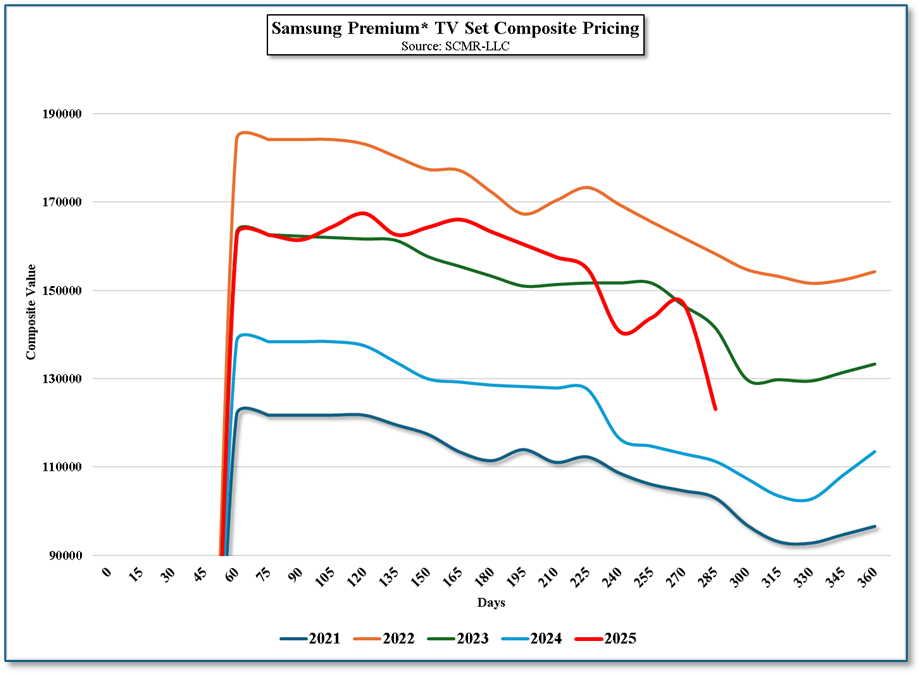

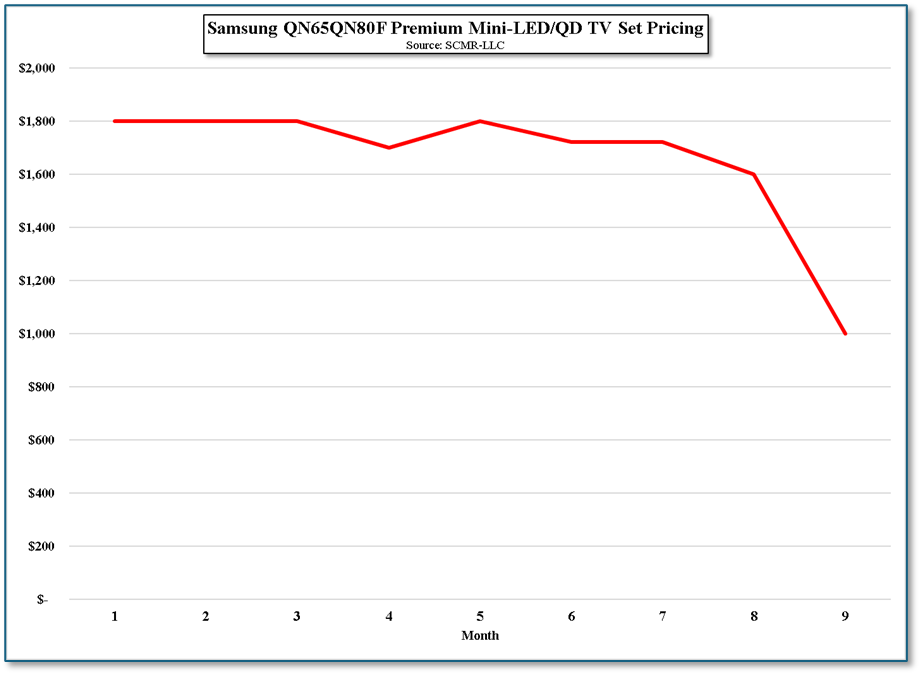

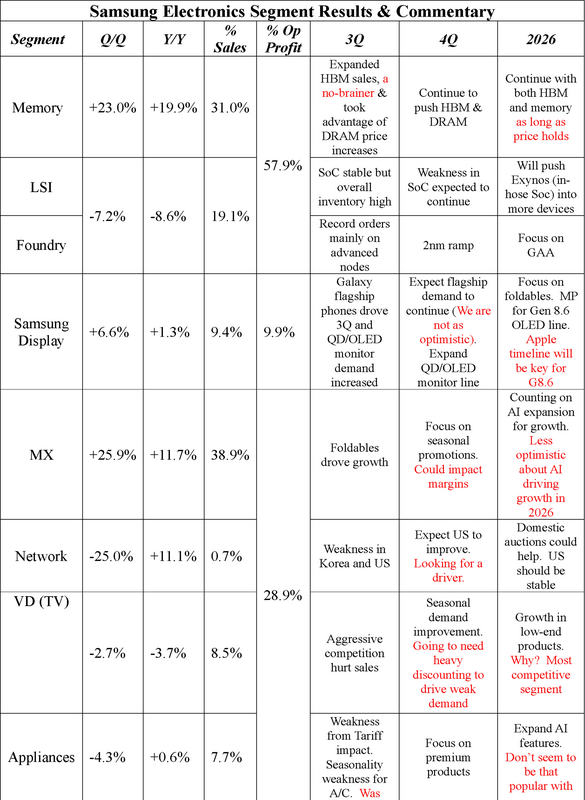

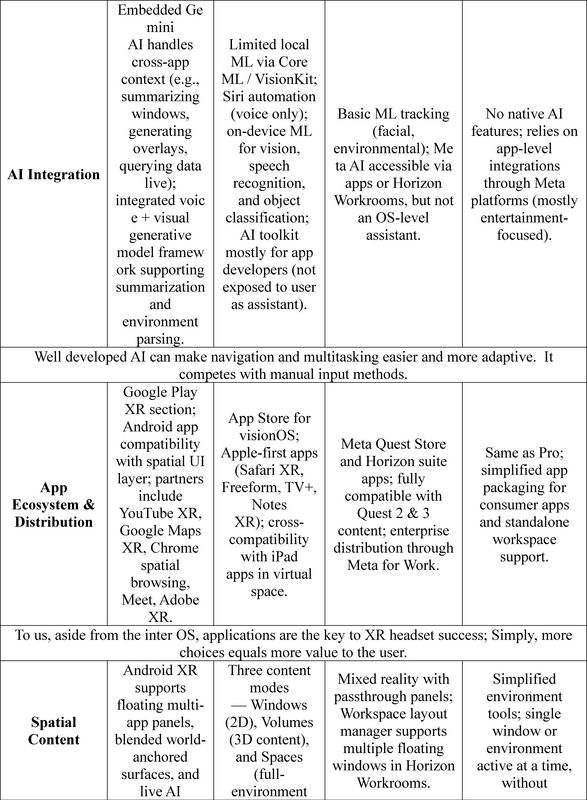

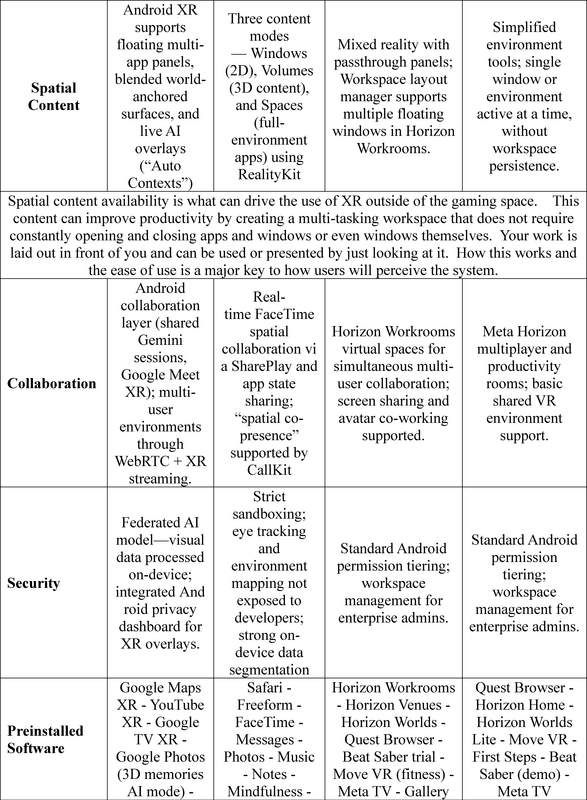

2025 points to a reaffirmation of Samsung’s TV set yearly pricing highs and lows, which we show in the table below and more visually in Figure 1. In order to better compare 2025 pricing trends between TV set product types we as set all prices to a common point in Figure 2 and Figure 3 to show how the sub-sets in each category have performed.

On a monthly basis Samsung’s Mini-LED 8K and 4K TV sets tracked almost identically through the year, with their highest prices between their late March release and the first discount point in May. Set prices continued to decline throughout the year. 8K sets faced some challenges in Europe which caused prices to rise but a workaround solved the issue and declines for 8K sets resumed.

Prime Day (week) typically in early July and July 4th sales mark the first price ‘adjustments’ that brands typically make on TV sets as they enter the slow summer season, with everything leading up to the Black Friday (month), which is characteristically the lowest price point of the year for premium TV sets. OLED TVs have a similar pattern during the year, although they do not seem to set a low during Black Friday and then recover as most of the other premium TV sets do. This year they have remained at or below their Black Friday lows.

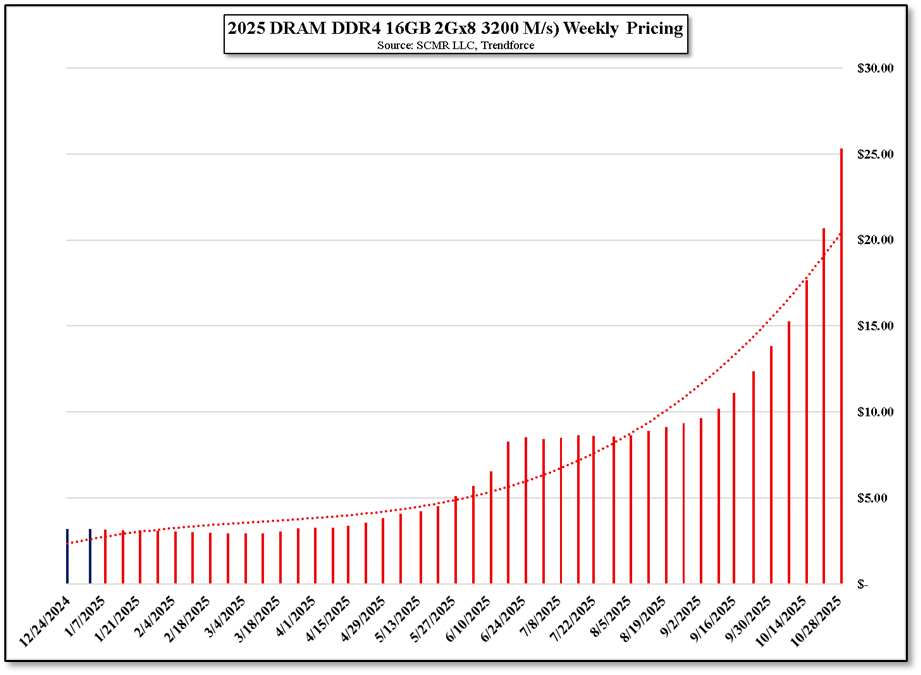

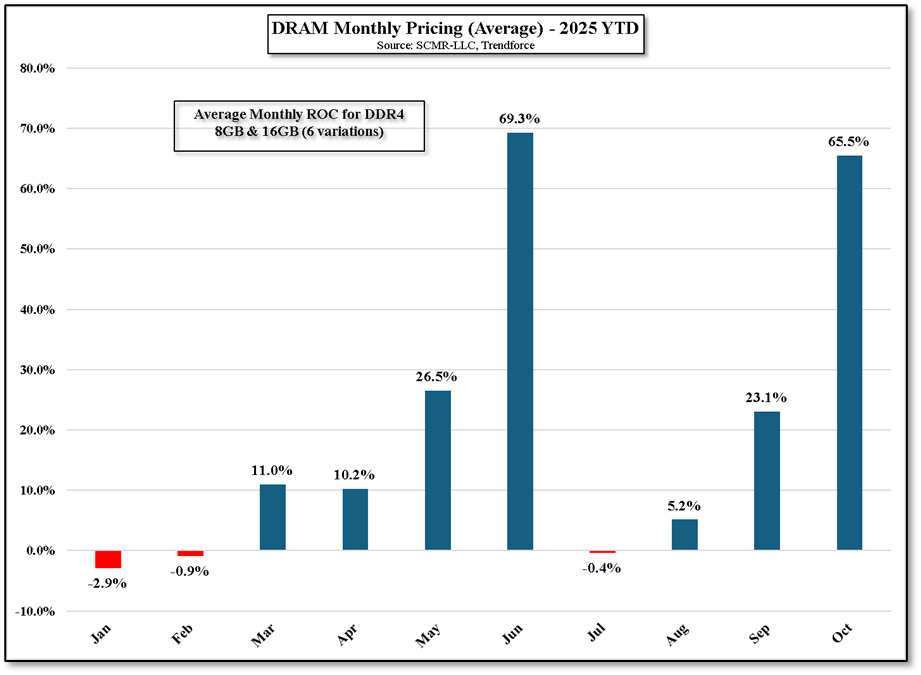

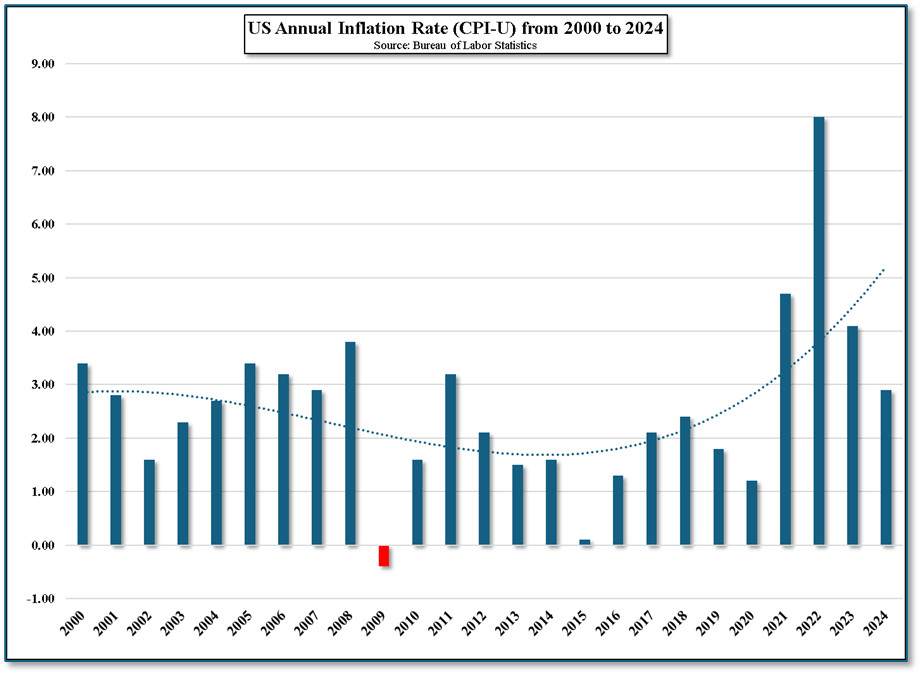

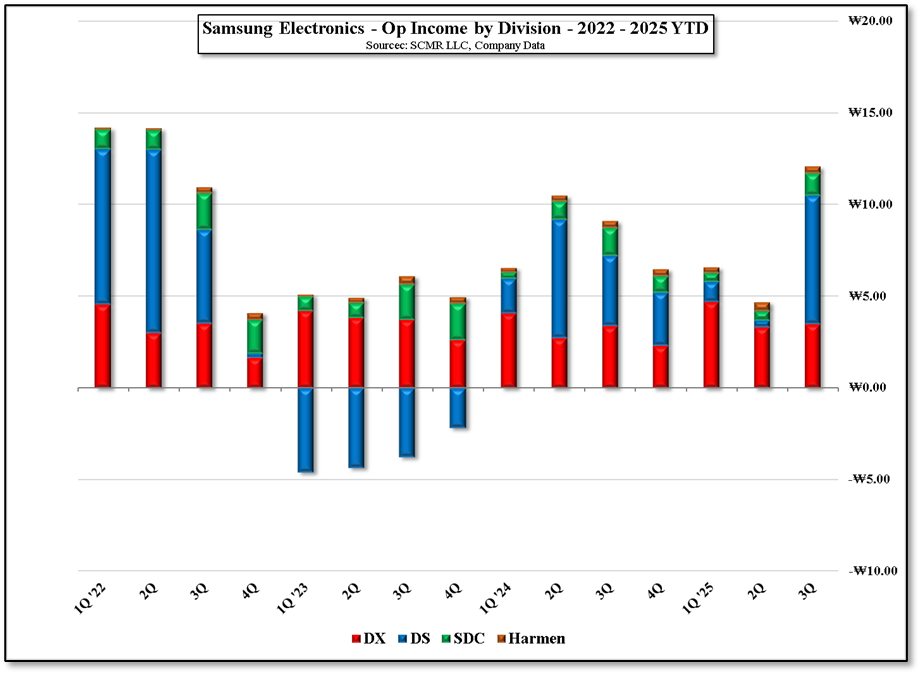

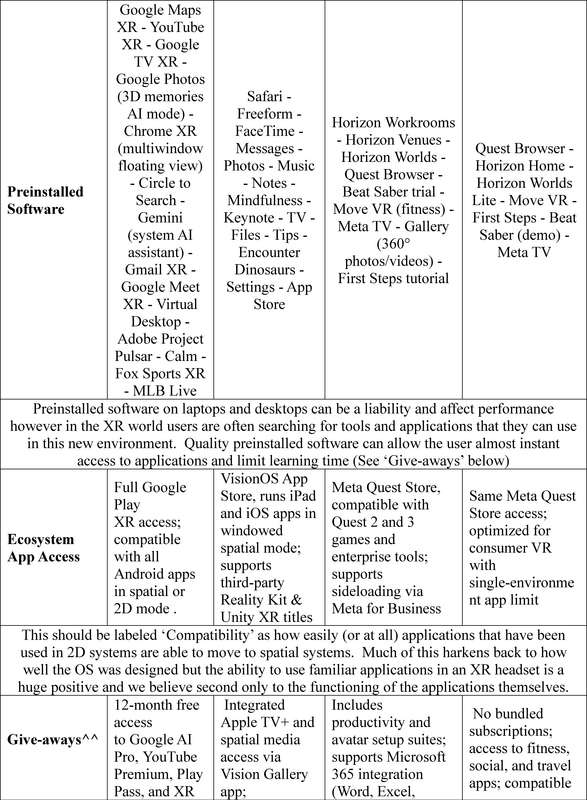

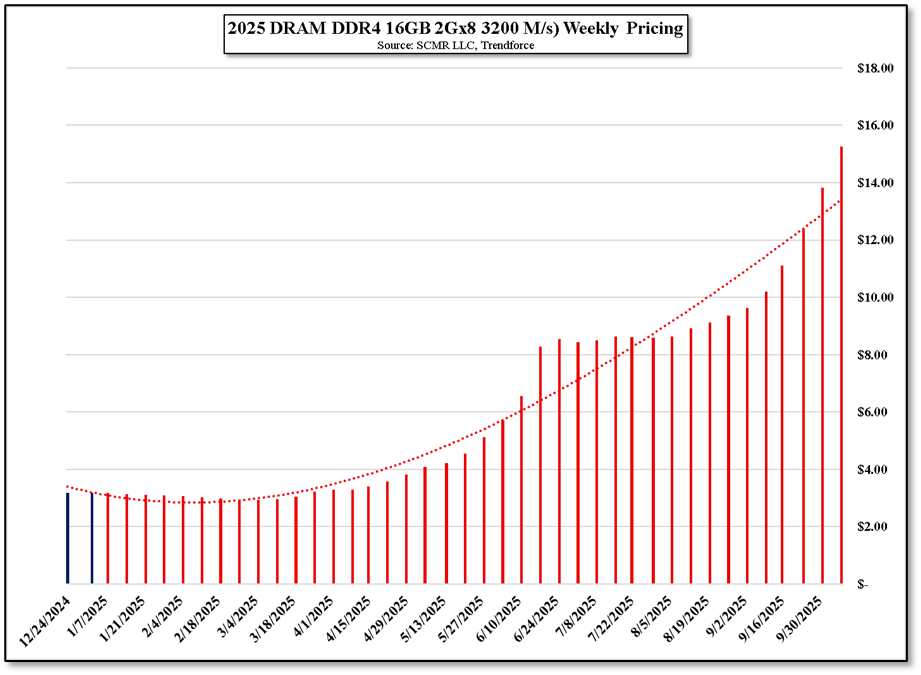

2026 Outlook: The Impact of DRAM and NAND price increases on TV Margins

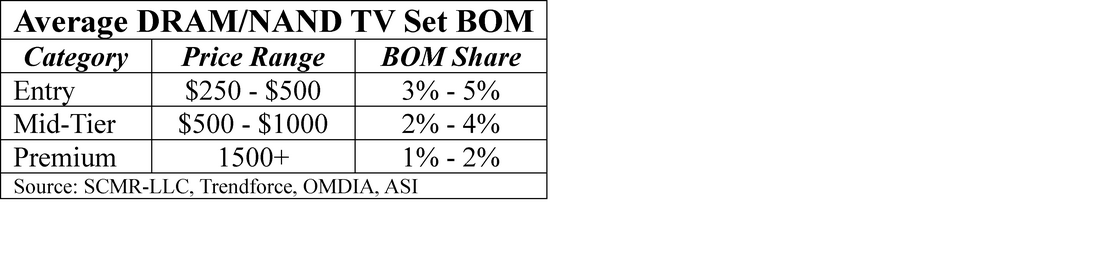

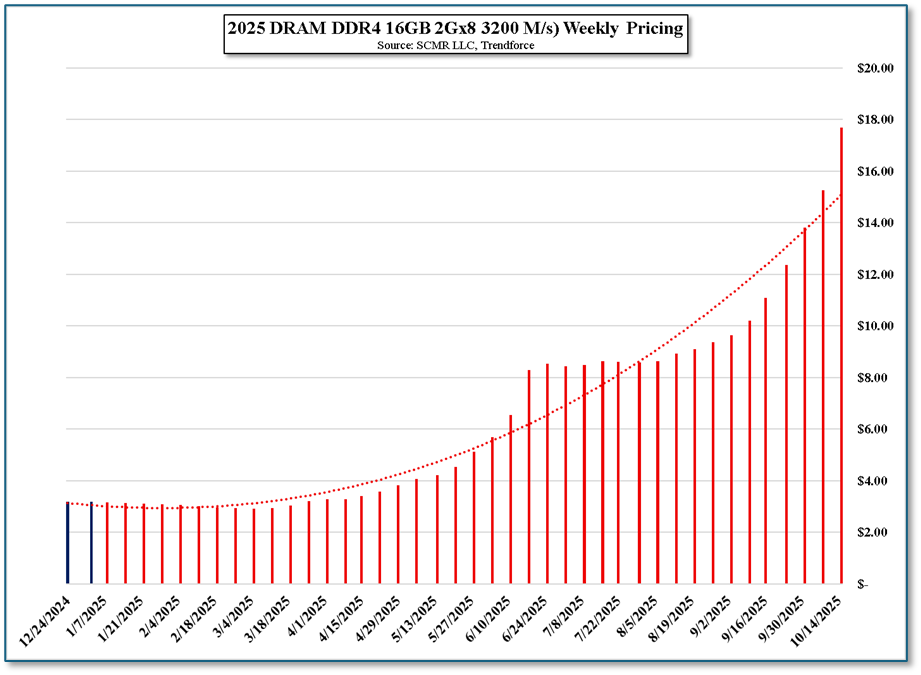

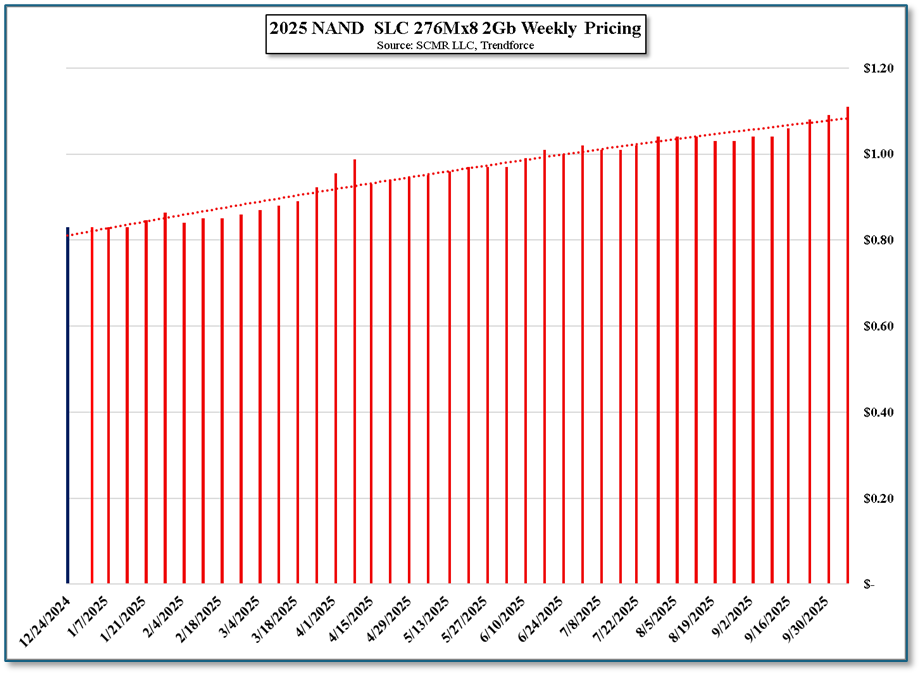

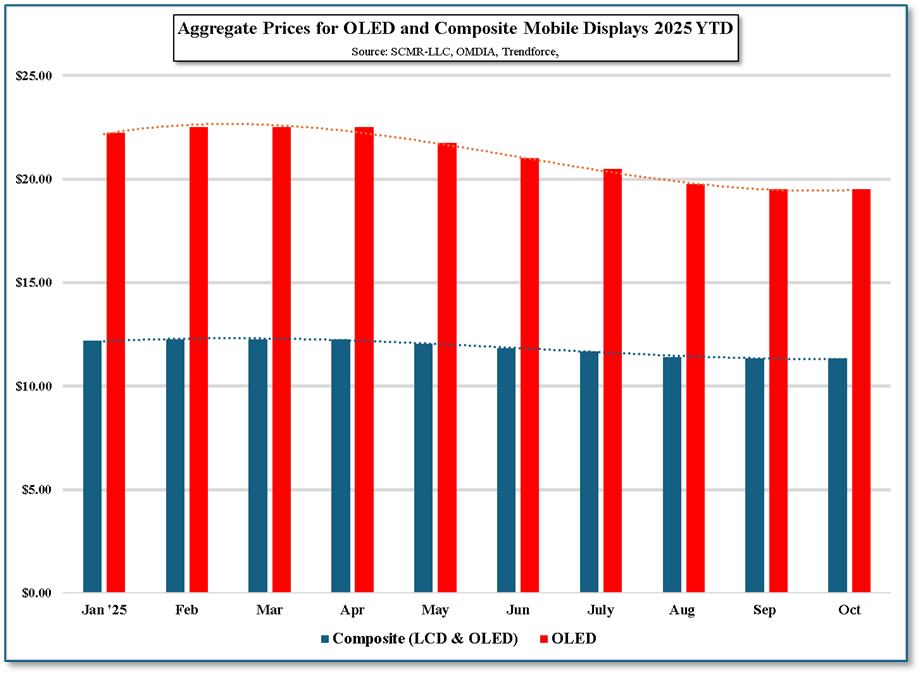

In most cases in 2025 the factors putting upward pressure on TV set pricing have been absorbed by panel producers and TV set brands, but 2025 saw a massive increase in DRAM/NAND memory prices and that continues to put pressure on TV set margins and other CE products. While we believe DRAM/NAND as a percentage of BOM is relatively small, ranging from 1% to 5% (See table below), the massive price increases seen in DRAM DDR4 (over 800% on average) this year have impacted margins far more deeply than anticipated and TV set brands are caught between the need to raise prices to maintain margins or absorb the increases and stay competitive. The offset, which is the saving grace for TV brands, is that TV panel prices have declined this year (~7.4% on average) and are a much larger (55% - 70%) part of the BOM. This has allowed entry level TV set pricing to remain relatively consistent as the BOM share of the display is highest in these products, while having a greater impact on premium TV sets, like the Samsung premium TVs we track closely.

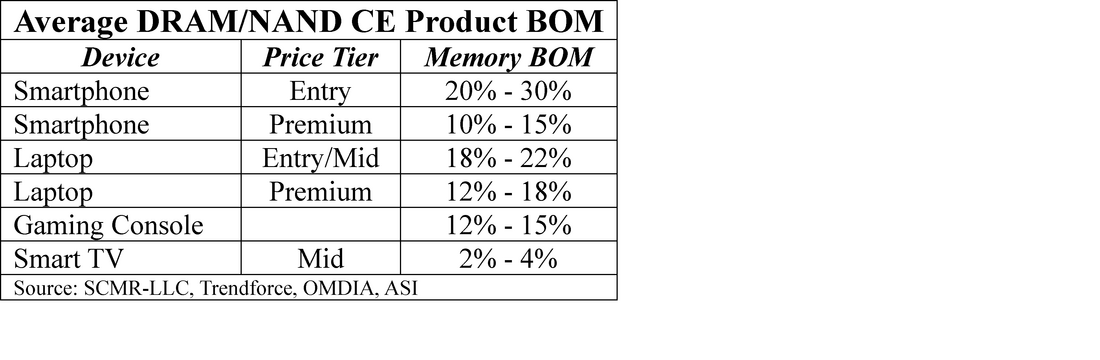

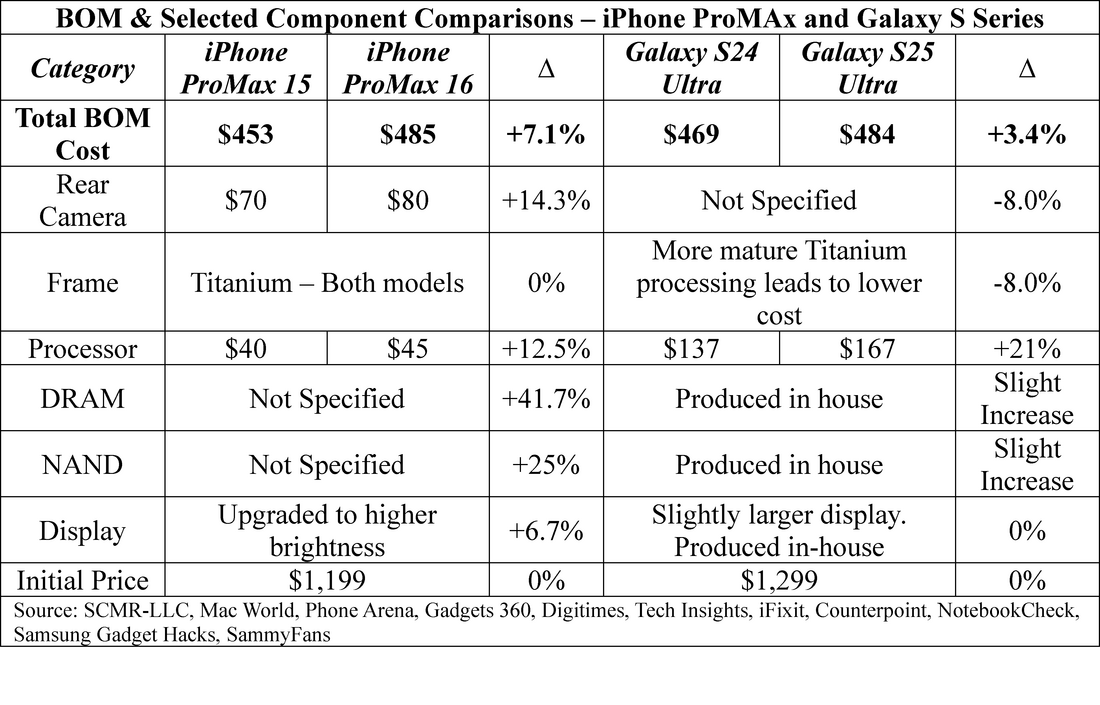

We expect that premium TV set brands, who are dependent on these higher margin sets, will face a difficult challenge in 2026; whether to raise prices to maintain margins or maintain share against competitors, but we expect that decision will be even more difficult for other CE product brands where the impact of DRAM/NAND pricing is greater. Smartphones, particularly entry level smartphones, are impacted to the greatest extent among common CE products, with DRAM/NAND making up between 20% and 30% of BOM (See table below), and we know that Samsung is in the process of deciding on whether to raise the price of the upcoming Galaxy S flagship line or maintain it at last year’s levels.

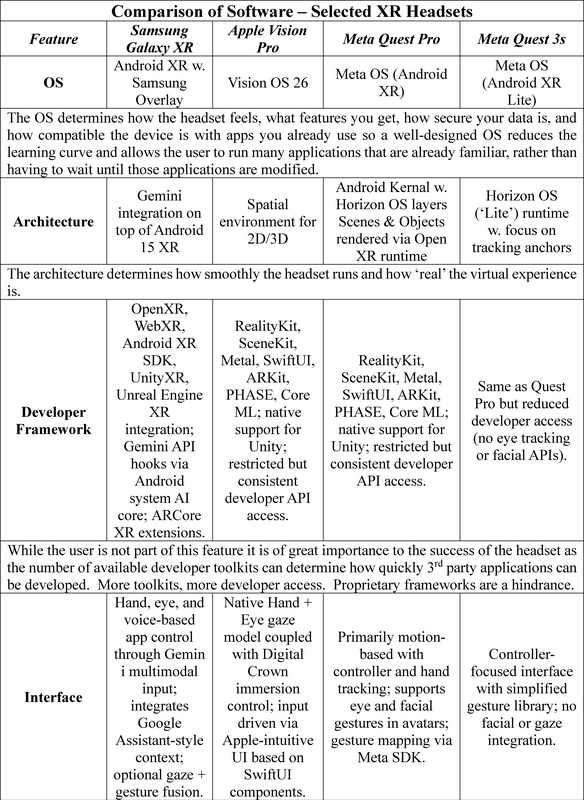

Samsung is in the unique position of being able to balance the loss of margin on smartphones against the increased margins on its DRAM/NAND production across the entire organization, but most other smartphone brands are not as lucky to have in-house memory production. That said, we expect little change in smartphone pricing in early 2026 as brands compete for share, but if DRAM/NAND pricing continues to rise through 1Q and beyond, we expect the normal price declines seen in most smartphones as they age through their 1st year pricing cycle will be less than usual. We expect brands will be careful to avoid competing on memory content, likely freezing standard memory sizes for most models, but iwe expect that typical smartphone pricing will be hard to maintain in 2026, even against the increased promotion of AI on mobile devices, as it seems most consumers consider AI readiness, either in applications or as an information tool something that should come with the phone rather than as an additional cost.

The 2025–2026 pricing cycle reveals a fundamental shift in the consumer electronics landscape. While Samsung has successfully maintained its 19-year dominance in the global TV market, the traditional "seasonal decline" model is being challenged by an unprecedented divergence in component costs.

Our data shows that Samsung’s premium TV sets followed a predictable high-to-low trajectory in 2025, with OLEDs notably remaining at or below Black Friday lows into early 2026. This aggressive pricing suggests that in the TV sector, where the display panel represents up to 70% of the BOM, the ~7.4% decline in panel costs has effectively subsidized the skyrocketing price of memory. For entry-level sets, this "panel buffer" is the only reason retail prices have remained stable despite DRAM contract prices surging over 800%.

However, this balancing act is not sustainable for other CE categories. For products like smartphones and laptops, where memory accounts for a massive 15%–30% of the BOM, the "Memory Crisis" has reached a breaking point. Samsung’s recent decision to freeze Galaxy S26 launch prices is a strategic sacrifice of margin to protect market share, a luxury few competitors can afford. Unlike rival brands, Samsung’s unique vertical integration allows it to offset hardware margin losses with the massive profits generated by its own semiconductor division.

Looking ahead to 2026, we expect two distinct market behaviors:

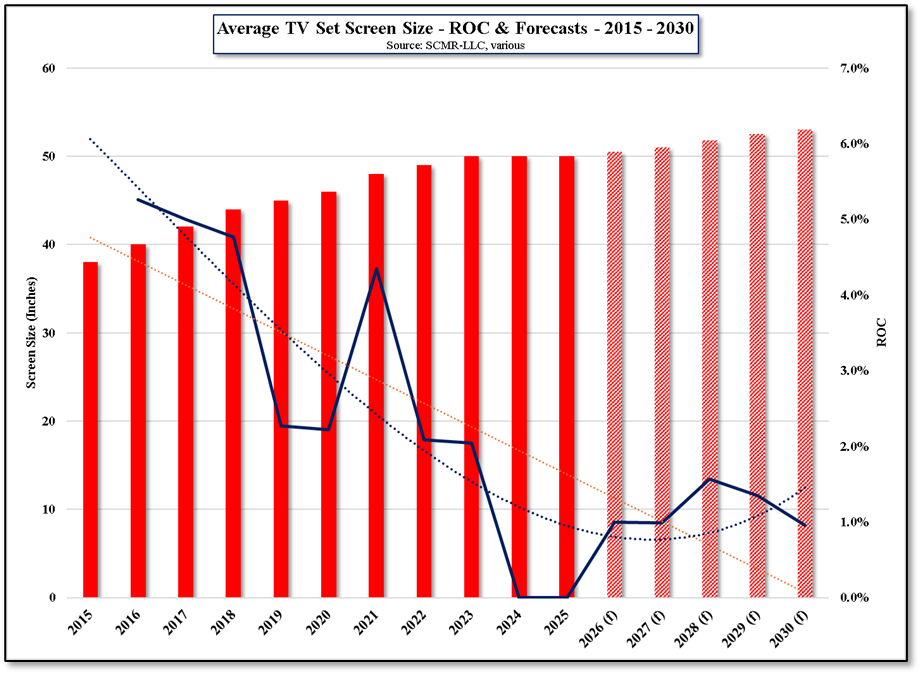

- In the TV Market: Premium brands will likely engage in "spec-shaving" (freezing RAM/NAND sizes) to maintain the current pricing floor, as consumers remain unwilling to pay more for "unseen" internal specs.

- In the Broader CE Market: We anticipate a "pricing floor" effect. The traditional mid-year price cuts for smartphones and laptops will likely be shallower than in previous years as brands struggle to recoup elevated component costs.

RSS Feed

RSS Feed